Making Tax Digital (MTD) will affect all VAT registered businesses with taxable turnover above £85,000 with most businesses as a minimum having to change the way they submit their VAT Returns from 1 April 2019. Through the past 12 months we have been busy behind the scenes ensuring that both we are ready for MTD and that our clients are ready for MTD. As the changes introduced by MTD are now almost upon us we thought it would be useful to set out a step by step guide to the actions required to get ready for MTD.

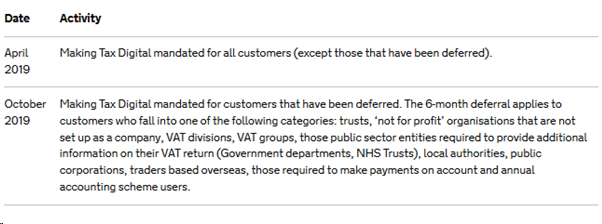

Making Tax Digital for VAT timeline

Step 1 – Confirm your start date for MTD (as per the above table).

It is important to note that HMRC will not tell you that you are obliged to comply with MTD, the obligation is on businesses to be ready to commence reporting under MTD from their start date unless HMRC writes to confirm that you qualify for the six month deferment. Failure to adhere to your MTD obligations will leave you exposed to potential penalties so if you have any questions or concerns please contact us.

It is important to note that HMRC will not tell you that you are obliged to comply with MTD, the obligation is on businesses to be ready to commence reporting under MTD from their start date unless HMRC writes to confirm that you qualify for the six month deferment. Failure to adhere to your MTD obligations will leave you exposed to potential penalties so if you have any questions or concerns please contact us.

Step 2 – Ensure that your software is compatible

Before you sign up to MTD you must have software that will allow you to submit VAT Returns in a manner that is compatible with MTD under the guidelines.

When choosing your software think about what your business requirements are. If you have yet to establish if your current software is compatible or if you need some advice on what software is best suited to you please get in touch and we can assist or arrange a demo as appropriate.

Some examples of compatible software are:

- Xero – https://www.xero.com/uk/

- QuickBooks – https://quickbooks.intuit.com/uk/

- Sage – https://www.sage.com/en-gb/

Step 3 – Sign up for MTD for VAT (at the correct time!)

Depending on when your next VAT Return is due to be submitted, you have a small window to sign up for MTD. See the attached timetable for the sign up periods, please pay close attention to this. If you are unsure please get in touch and we will be happy to assist.

After you sign up you will receive an email within 72 hours to confirm that you can submit your VAT returns using software that is MTD compliant.

Once you sign up for MTD, HMRC will expect the next VAT return to be submitted under MTD. It is therefore vital that you sign up at the right time. Do not sign up to submit the current period VAT return until the previous period’s return has been submitted, please get in

touch if you are unsure.

After you sign up you cannot use VAT online services to submit your VAT Returns.

Step 4 – Authorise your software

Before you can send your VAT returns, you will need to authorise your software. The steps to do this will vary depending on your software.

Need Help?

If you are unsure of the position or how to progress things, please give Laura Barrie, our Business Support Manager, a call on 0141 848 7474 or use our contact page to get in touch.